Machinery & Equipment

Global Incubator Market Size and Growth Outlook (2025–2032): From Equipment Prices to Incubation Efficiency and Lifecycle Costs

20 January 2026

January 20, 2026—According to APO Research, Inc., the global Egg Incubator market delivered about US$ 819 million in 2025 and is expected to reach around US$ 879 million in 2026; by the end of 2032 the market is likely to approach about US$ 1.08 billion, expanding at an annual CAGR of approximately 3.6% from 2026 to 2032. In day-to-day procurement, buyers rarely treat egg incubators as standalone machines; they are evaluated as hatchery-critical assets where hatch rate stability, chick uniformity, biosecurity discipline, uptime, and lifecycle serviceability translate directly into cost per chick and batch-level predictability.

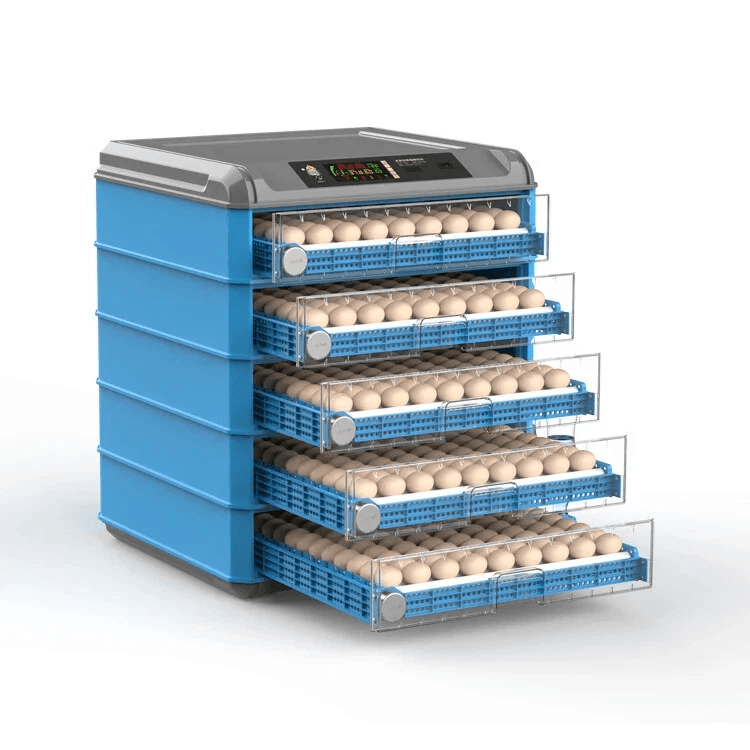

Egg incubator is a controlled-environment incubation apparatus that maintains a defined thermal, humidity, and ventilation envelope—and, where required, automated egg turning—to support embryonic development and achieve repeatable hatch performance outside the parent organism. In commercial and laboratory practice it is engineered as either still-air or forced-air (fan-circulated) equipment and may be configured as single-stage or multi-stage, with “setter” and “hatcher” functions separated in higher-throughput poultry systems to manage differing airflow, humidity, and contamination-control requirements across incubation phases.

From a build standpoint, an egg incubator is typically an insulated enclosure with a heat source and distribution path (resistive heater, heat spreader, forced convection fan), humidity generation and buffering (water pan, wick, ultrasonic or heated humidifier), controlled ventilation (adjustable inlets and exhaust, optional filtration), egg handling hardware (turning trays, tilt frames, rollers, or rack systems), and instrumentation plus control electronics (RTD or thermistor temperature sensing, humidity sensing, PID or closed-loop control, alarms and logging). Materials are selected for hygiene, thermal stability, and corrosion resistance: housings are commonly ABS or PP (consumer units) or powder-coated sheet steel or stainless steel (industrial units), with aluminum subframes, PU-foam or EPS insulation, polycarbonate or PMMA viewing windows, and silicone gaskets for sealing; fluid-contact humidity components favor inert plastics and stainless hardware. Manufacturing commonly combines sheet-metal fabrication or injection molding, insulation foaming and sealing, fan/heater and wiring harness integration, PCB assembly, sensor calibration and functional verification (temperature uniformity, recovery time, turning cycle accuracy, leak and safety checks), and final hygiene-oriented finishing suited to repeated cleaning and disinfection.

Demand remains anchored in commercial hatcheries, which account for roughly three-fifths of 2025 market value, with poultry breeding companies and production farms contributing most of the remaining volume-driven spend; hobbyist demand is visible but structurally small. This end-market profile naturally favors scale and automation: large incubators represent about two-thirds of 2025 value, medium systems roughly a quarter, while small units primarily serve decentralized or low-batch environments. As a result, purchasing decisions tend to prioritize line compatibility, energy and airflow management, cleaning and disinfection practicality, and the supplier’s commissioning and after-sales response capacity.

Regionally, Asia-Pacific is the largest market in 2025 at roughly half of global value, followed by Europe at about one-quarter; North America sits in the low-teens share range, while the Middle East and Africa provide steady incremental demand and South America remains comparatively small. Moving into 2026, the regional hierarchy stays intact, and growth is more closely linked to capacity upgrades and new-build hatchery projects than to short-lived regional spikes, reinforcing the value of local service footprint, spare-parts logistics, and predictable installation timelines.

The supply landscape is concentrated at the top but highly fragmented overall. In 2025, Petersime N.V., Royal Pas Reform, and Jamesway together account for about 26% of market value; the top five suppliers are around 32%, while the long tail still represents roughly 61%, reflecting the persistence of regional brands and niche solution providers. Based on recent share patterns, top-tier concentration in 2026 is likely to remain in the low-30% range, meaning vendor selection often comes down to a practical trade-off between performance repeatability and local delivery-and-service certainty.

From an engineering and operations perspective, the market’s improvement path is driven less by marketing features and more by hard constraints: long-term drift management of sensors and actuators, chamber uniformity and airflow design, alarm logic and traceable batch data, cleanability and biosecurity-friendly design, and maintainable control architectures with serviceable components. By the end of 2032, growth is expected to be shaped primarily by replacement cycles, automation retrofits, and maintenance digitalization, supporting a steady, production-economics-led expansion profile.