Medical Devices & Consumables

GLP-1 Receptor Agonist Therapies (GLP-1 Drugs): From T2D to Weight Management, Scaling into a Chronic-Disease Platform

19 December 2025

Glucagon-like peptide-1 (GLP-1) drugs are peptide therapeutics that mimic or potentiate the actions of endogenous GLP-1 at the GLP-1 receptor, a class-B G-protein–coupled receptor expressed on pancreatic islet cells, in the gastrointestinal tract, and in the central and cardiovascular systems. Pharmacologically they restore or amplify the physiologic “incretin effect”: in hyperglycaemic states they enhance glucose-dependent insulin secretion from β-cells, suppress inappropriate glucagon from α-cells, slow gastric emptying early in treatment, and reduce appetite via hypothalamic and brainstem pathways. Because their insulinotropic action is glucose-dependent, GLP-1 receptor agonists (GLP-1RAs) have a low intrinsic risk of hypoglycaemia unless combined with insulin or insulin secretagogues, while their gastrointestinal effects (nausea, vomiting, diarrhoea) are class-typical, dose-related and mitigated by stepwise titration.

At the molecular level the class spans two lineages. Exendin-based agents (e.g., exenatide and lixisenatide) derive from exendin-4 and are naturally DPP-4–resistant. Human-sequence analogues (e.g., liraglutide, semaglutide) and fusion constructs (e.g., dulaglutide) introduce substitutions or conjugations that protect the peptide from dipeptidyl peptidase-4 and renal clearance and, in long-acting variants, promote albumin binding or extend half-life through Fc fusion or PEGylation. Liraglutide carries a C16 fatty-acid side chain to bind albumin; semaglutide combines a DPP-4–resistant substitution with a C18 fatty-acid–spacer for strong albumin binding; dulaglutide fuses two GLP-1 analog moieties to a modified IgG4 Fc to slow elimination; exenatide extended-release incorporates the peptide into PLGA microspheres for weekly release; oral semaglutide employs the absorption enhancer SNAC to enable gastric uptake of an otherwise parenteral peptide. These structural strategies drive pharmacokinetics and clinical phenotype: short-exposure agents exert a proportionally larger post-prandial effect (via gastric emptying), while sustained-exposure agents have stronger fasting-glucose effects and smoother 24-hour control.

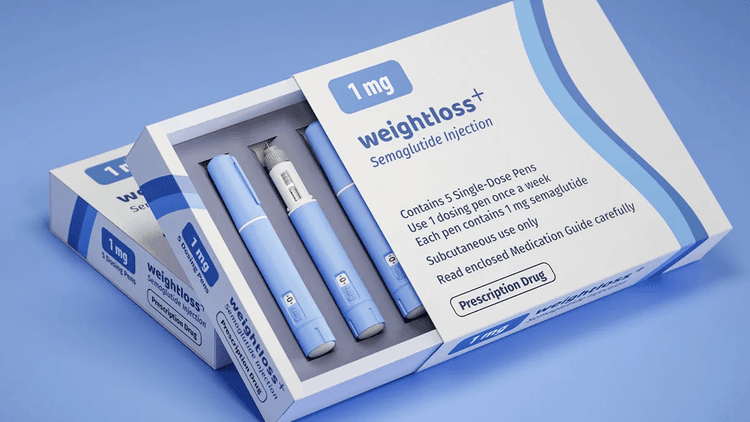

For clarity in product mapping, the marketed GLP-1RA portfolio covers human-sequence and exendin-based APIs across daily, weekly and oral modalities. Representative single-agent brands include exenatide immediate-release (Byetta) and extended-release (Bydureon/BCise), lixisenatide (Adlyxin/Lyxumia), liraglutide daily injection for diabetes (Victoza) and for weight management (Saxenda), dulaglutide weekly injection (Trulicity), semaglutide weekly injection for diabetes (Ozempic) and for weight management and cardiovascular risk reduction in appropriate populations (Wegovy), and semaglutide oral tablets (Rybelsus). Fixed-ratio combinations pair a GLP-1RA with basal insulin—insulin degludec + liraglutide (IDegLira; Xultophy) and insulin glargine + lixisenatide (iGlarLixi; Soliqua/Suliqua)—to streamline intensification in type 2 diabetes. Regional markets also include China domestic GLP-1RAs such as beinaglutide (short-acting, human-sequence GLP-1[7-36]) and PEG-loxenatide (weekly PEGylated exendin analogue). Dual- or multi-receptor incretin agonists exist but, by definition, sit outside the “GLP-1-only” class.

Indications in routine practice cluster into three labeled application domains. In type 2 diabetes (T2D), GLP-1RAs are used as an adjunct to diet and exercise as monotherapy when metformin is inappropriate, or in combination with oral agents and/or insulin when additional glycaemic control is needed; some agents have paediatric T2D labeling. In chronic weight management (Obesity), higher-dose liraglutide and semaglutide carry indications for adults with obesity or overweight with weight-related comorbidities, and certain labels extend to adolescents. In cardiovascular risk reduction (CV risk), specific products are approved to reduce major adverse cardiovascular events in adults with T2D and established atherosclerotic cardiovascular disease, and selected high-dose semaglutide carries a cardiovascular-risk reduction label in adults with established CVD who are overweight or obese. Risk-reduction labeling in chronic kidney disease for T2D populations is best treated as a T2D sub-label rather than a separate application domain. These labeled uses are product-specific; they should not be generalized across the entire class without reference to the individual label.

Mechanistically, receptor activation increases intracellular cAMP and engages PKA and Epac2 pathways, amplifying the β-cell exocytotic response to glucose, modulating β-cell gene expression and survival signals, and repressing α-cell glucagon in hyperglycaemia. In the gut, vagal and local effects slow gastric emptying at treatment initiation, which blunts post-prandial glucose excursions; this effect often attenuates with chronic dosing for long-acting agents. In the CNS, activation of POMC/CART neurons and downstream circuits decreases appetite and energy intake; peripheral effects on adipose tissue, liver and kidney contribute to weight loss and natriuresis. Cardiometabolic benefits observed in outcome studies likely reflect an integrated impact on weight, blood pressure, glycaemia, lipids and vascular inflammation rather than a single pathway.

Pharmacology and formulation determine dose cadence and “type.” In market segmentation, short-acting agents are those given daily or multiple times per day and are characterized by prominent post-prandial control; examples include exenatide immediate-release, lixisenatide and daily liraglutide. Long-acting agents deliver sustained exposure with weekly administration or, in the case of oral semaglutide, long pharmacodynamic activity despite daily dosing; examples include dulaglutide, semaglutide subcutaneous weekly, exenatide extended-release and PEG-loxenatide. Fixed-ratio combinations couple a GLP-1RA with basal insulin to produce complementary fasting and prandial control in a single daily injection. Oral semaglutide provides a non-injectable option but introduces administration rules—fasting state, limited water intake, and a wait period before food or other medications—that can affect real-world adherence.

Adherence is driven by device, titration and tolerability. Weekly autoinjectors lower injection burden and generally improve persistence compared with daily injectables, but gastrointestinal tolerability still requires careful uptitration. Oral semaglutide avoids needles yet trades that advantage for fasting-administration complexity; some patients prefer daily pens for simplicity once trained. Across the class, gradual dose escalation from a low introductory dose is central to minimizing GI symptoms. Most agents have low intrinsic hypoglycaemia risk when used without insulin or sulfonylureas; combination use often necessitates down-titration of the concomitant secretagogue or basal insulin as glycaemia improves. Class warnings include a contraindication in patients with personal or family history of medullary thyroid carcinoma or MEN2 for labels that carry a C-cell tumor warning, caution in patients with prior pancreatitis, and attention to gallbladder disease signals. Slowed gastric emptying can alter the absorption of co-administered oral drugs with a narrow therapeutic window, which warrants timing adjustments in practice. Rapid glycaemic improvement in susceptible patients may transiently worsen retinopathy and should be monitored.

From a development standpoint the class evolved from twice-daily exendin-based injections to weekly sustained-exposure analogues and, most recently, to high-dose weight-management regimens and an oral tablet formulation. Cardiovascular-outcomes programs transformed GLP-1RAs from pure glucose-lowering agents into cardiometabolic medicines with event-reduction labels for selected products and populations. Manufacturing has scaled from conventional peptide synthesis and sterile vialing to sophisticated autoinjector pens, PLGA microsphere encapsulation and tablet technologies that enable gastric uptake; these choices shape supply chains, dose flexibility and cost profiles.

GLP-1 drugs are a coherent but diverse class unified by a glucose-dependent incretin mechanism and differentiated by structure, exposure profile, dose form and label. The practical taxonomy that matters in clinical and market analysis is simple and serviceable: type by dosing profile (Short-acting; Long-acting; Fixed-ratio combo), modality by route (injection; oral), and application by labeled domain (T2D; Obesity; CV risk). Within that frame the choice of agent is a balance among glycaemic and weight targets, cardiovascular risk status, patient preference for frequency and route, and the operational realities of access, price and supply.

GLP-1 drugs have evolved from a diabetes-centric therapy class into a global chronic-disease platform spanning type 2 diabetes, cardiovascular risk management, and weight management, with access and supply execution now as decisive as clinical demand. In 2025 the market delivered about US$77.0 billion; it is expected to reach around US$101.5 billion in 2026 and approach US$482.1 billion by 2032, with the market projected to grow at a CAGR of approximately 30% from 2026 to 2032. In practice, buyers and payers treat GLP-1 as a managed category where formulary status, eligibility criteria, persistence programs, and dependable supply shape realized volumes and net pricing.

The manufacturer landscape is exceptionally concentrated, which materially influences pricing power, contracting behavior, and substitution dynamics. In 2025, Novo Nordisk and Eli Lilly together accounted for roughly 99% of global revenue at about US$38.7 billion and US$37.6 billion respectively, leaving limited room for meaningful multi-sourcing in most markets. Given that backdrop, the global top three share in 2026 is still expected to sit near the 99% range, implying that near-term competitive change is more likely to be expressed through access expansion and capacity scale-up than through fragmentation of the supplier base.

Product form is already a settled decision axis: long-acting therapies generated about US$74.5 billion in 2025, close to 97% of total revenue, and are expected to reach around US$99.1 billion in 2026; short-acting products remain a small, pathway-specific segment. Indication mix provides the more decision-relevant read-through on where incremental demand is being monetized: in 2025, T2D contributed about US$48.0 billion, cardiovascular risk about US$20.4 billion, and obesity about US$8.5 billion; by 2026 those are expected to reach roughly US$64.8 billion, US$24.6 billion, and US$12.1 billion. The strategic point for payers is that growth is increasingly tied to long-horizon outcomes and total medical cost narratives, not just glucose control.

Regionally, North America remained the primary revenue engine in 2025 at about US$51.7 billion, representing roughly two-thirds of the global market, while Europe and Asia Pacific followed at around US$13.8 billion and US$10.1 billion. The operational constraints are well understood across the value chain: peptide API scale, fill-finish throughput, injection device and packaging availability, cold-chain integrity, and payer utilization management can each become the gating factor depending on market and quarter.