Energy & Power

Shore power revenue to grow from $870 million to $1.6 billion: Variable frequency drives and transformers account for over 60% of the growth (2026–2032)

22 December 2025

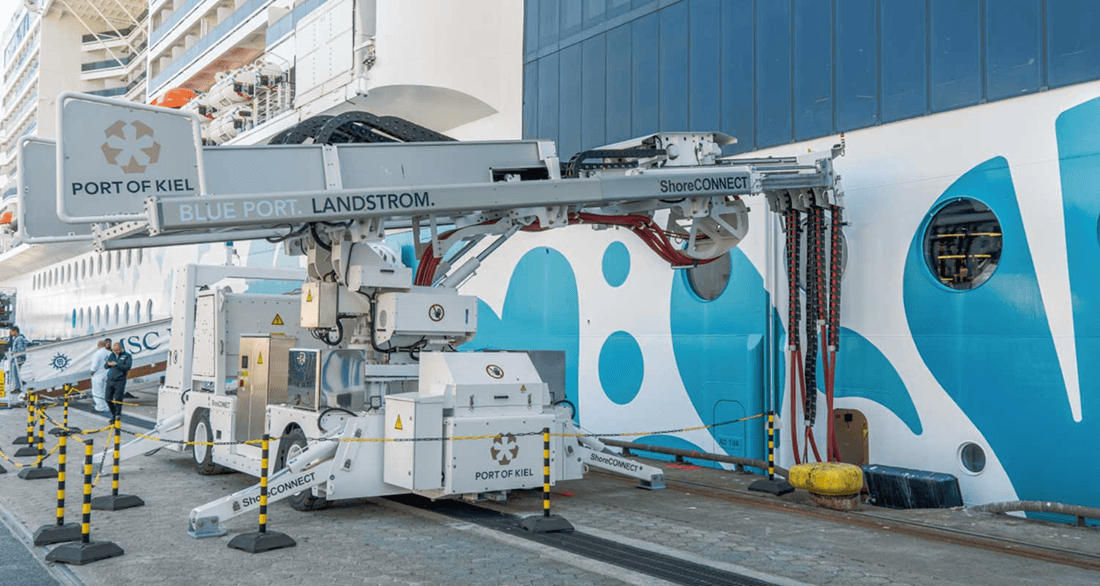

Shore power is the provision of electrical power from the landside grid or an onshore power system to a vessel at berth so onboard loads can be supplied with engines and auxiliary generators shut down or minimized, typically via standardized high-voltage or low-voltage ship-to-shore connections and associated conversion, protection, and synchronization equipment. It is defined by the power interface (voltage, frequency, capacity), the connection and safety system (cables, plug and socket, earthing, interlocks), and its operational purpose of reducing port emissions, noise, and fuel consumption during hoteling and cargo-handling periods.

In 2025 the Shore Power market delivered about US$ 817.9 million; it is expected to reach around US$ 868.6 million in 2026 and approach US$ 1,600.3 million by 2032, the market is projected to grow at a CAGR of approximately 10.7% from 2026 to 2032. In practical procurement terms, shore power is not a single box purchase but an integrated onshore power supply and cold ironing system that must work reliably across berth operations, grid constraints, and shipboard load transfer, with safety interlocks and power-quality performance carrying as much weight as nameplate power.

What makes the category decision-relevant is where money and risk concentrate. The spend is structurally shoreside: about US$ 711.7 million in 2026 versus about US$ 156.9 million shipside, and by 2032 the same pattern holds at roughly US$ 1,321.3 million shoreside versus about US$ 278.9 million shipside. The bill-of-materials logic is equally clear in 2026: frequency converters and transformers together represent well over sixty percent of market value, making power electronics design, redundancy philosophy, harmonics management, and protection coordination the real differentiators that buyers feel in commissioning time, availability, and lifetime maintenance burden.

Europe remains the pacing region in deployment and standardization, and the numbers reflect that. In 2026 Europe is about US$ 449.3 million, materially ahead of North America at about US$ 208.5 million and Asia-Pacific at about US$ 207.7 million; by 2032 Europe is expected to be close to US$ 796.6 million, while North America and Asia-Pacific each approach about US$ 400 million. For suppliers, this mix forces a two-speed playbook: compliance-led, audit-ready deliveries in mature ports, and execution-led programs elsewhere where grid connection approvals, berth civil works, and local EPC capability dictate schedule more than factory lead times.

Penetration is still the hard constraint that shapes real-world economics. Only a small fraction of global commercial ports are equipped, and the subset capable of supporting large cruise vessels at scale is smaller still, so value creation depends on synchronized investment across ports, shipowners, and route operators rather than isolated capex. On a system-equivalent basis, deployments move from about 490 units in 2025 to around 530 units in 2026 and roughly 1,020 units by 2032, with outcomes hinging on berth-side grid capacity upgrades, tariff predictability and demand-charge treatment, and operational integration such as metering, billing, and remote diagnostics.

The supplier landscape combines global integrators and regionally anchored execution capacity. Siemens, Hitachi Energy, Nidec ASI, Schneider Electric, Cavotec, and GE Vernova anchor turnkey capability across conversion, distribution, and controls, while players such as Nexans and Hubbell sit close to cables and connectivity realities on the quay, and NARI Technology and Xuji Group strengthen local grid-interface and engineering delivery. 2025 concentration levels put the top three vendors at roughly the high-55% share range, meaning buyers can obtain bankable references from the leaders but still face a long-tail of site-specific engineering outcomes; the winning bids are typically those that can prove repeatable commissioning, predictable maintenance, and safe ship-berth interoperability under variable grid conditions through to the end of 2032.